Plan for a Bright Future

By Karen Doss Bowman | Tuesday, February 23, 2021

Josie Badger, DHCE, CRC, has used everything that life has handed her, including her disability, to pursue her dreams. Diagnosed with congenital myasthenic syndrome (CMS) at age 11, Josie now relies on a ventilator, power wheelchair, and 24-hour care. While many would see such challenges as a roadblock to pursuing an occupation, she has used them to fuel a career she is passionate about: advocating for disability rights.

Along with the ability to achieve personal goals, maintain employment, and live independently comes the challenge of managing finances, budgeting, and saving for the future. Long-term financial planning ensures provision for medical expenses, equipment needs, nursing or attendant care, and the pleasures of ordinary life.

Josie Badger and her husband, Mike, used an ABLE account to buy their first house.

“For me, financial planning was just as important as obtaining employment in the pursuit of my dreams and calling,” says Josie, founder and president of J Badger Consulting, which provides youth development and disability consulting services to organizations. “As a person with a disability, I am reliant on governmental benefits [Medicaid] for my survival. I have to be aware of and utilize all the current financial-planning tools and savings options available to people with disabilities to be able to live the life that I have worked for.”

Plan for life

Today, more Americans with disabilities, like Josie, are working, starting families, and leading full lives.

“Because planning for someone with special needs is complex, it is critical to work with specialists in the field,” says Cynthia Haddad, CFP, co-founder and partner of Special Needs Financial Planning, a specialty practice of Affinia Financial Group. “Working with knowledgeable professionals helps you prevent mistakes as well as take the emotions out of what are often very emotional decisions. Each planning strategy, financial tool, or legal document you use will have an impact on government benefits and potential government benefits, as well as on you, your family, and your network of support, today and in the future.”

Cynthia Haddad co-founded a special needs financial planning practice.

Addressing financial concerns can be daunting, but there are many financial tools and programs available to individuals and families impacted by disabilities.

ABLE accounts

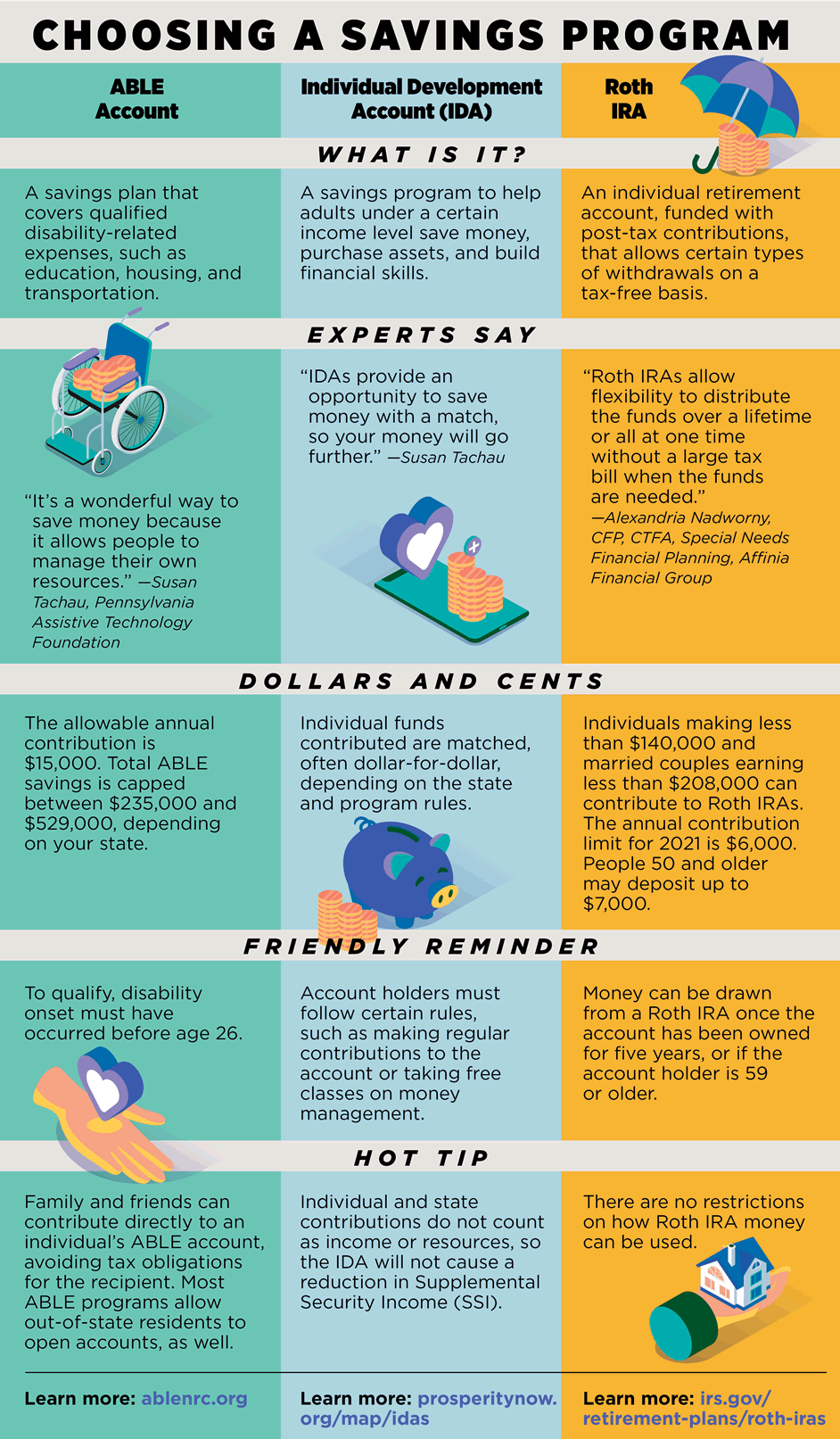

The Achieving a Better Life Experience (ABLE) Act, passed into law by Congress in 2014, allows people with disabilities to save money in ABLE accounts. These tax-exempt savings plans cover qualified expenses in areas such as education, housing, and transportation. Money in an ABLE account does not affect qualification for public assistance like Medicaid, though savings greater than $100,000 may impact an individual’s benefit amount.

When Josie and her husband set out to buy their first house, they leveraged her ABLE account — comprising contributions from Josie and her parents — to save $18,000 for a down payment.

“With an ABLE account, the person with the disability can control their own money,” says Susan Tachau, co-founder and chief executive officer of the Pennsylvania Assistive Technology Foundation. “They can use it for utilities, rent, and food, but also for things that improve their quality of life, such as assistive technology.”

Government benefits

The federal government offers a number of support programs, including Supplemental Security Income (SSI), Social Security Disability Insurance (SSDI), Medicaid, and the Children’s Health Insurance Program (CHIP). Each state has specific options and rules about how much an individual can earn or save while receiving these benefits.

“Part of financial planning is making sure we protect an individual’s eligibility for government benefits,” Cynthia says. “If you don’t plan, you may unintentionally disqualify the person for these benefits, which are a lifeline for medical services, personal attendant care, personal care services, equipment needs, and more.”

Programs such as the Individual Development Account (IDA), offered by the Social Security Administration, help people with lower incomes grow their assets and achieve financial stability. IDAs can be used to pay for education, start a business, or purchase assistive technology. In many states, every dollar an individual puts into their IDA is matched by the state’s Temporary Assistance for Needy Families (TANF) program or other special funds. In exchange for the matching dollars, the IDA account holder must follow certain rules, such as making regular contributions to the account or taking free classes on money management.

Employer benefit programs

Benefits offered by employers may be useful tools for budgeting income and care needs and retirement planning. These options include long-term disability insurance, long-term care insurance, and life insurance. A company retirement plan may offer early retirement for rollovers, loans, or distributions. Some plans waive the 10% penalty when early withdrawal is made because of disability.

Money can be set aside for medical expenses and other qualifying needs through flexible spending accounts (FSAs) or health savings accounts (HSAs), which accompany high-deductible health plans. Money saved into these accounts is taken out of the payroll check before taxes.

Cynthia also points out that some life insurance policies offer riders for early access, or a “disability waiver rider” option, allowing the holder to stop making premium payments without losing death benefit coverage. Review your policy’s options with your insurance provider or a financial advisor.

Individual retirement accounts

Adults who are earning an income might consider setting up a Roth IRA, an individual retirement account that allows certain types of withdrawals on a tax-free basis. Unlike the traditional IRA, which is funded with pretax contributions, the Roth IRA is established with money that has already been taxed. It offers flexibility, allowing contributions with earned income at any age and setting no minimum distribution requirements. With documentation of a disability, it might be possible to take funds out of a Roth IRA before the age of 59½. The Roth IRA also may be a good option for funding a special needs trust.

Estate planning

Parents can make financial provisions for children of all ages through a special needs trust, ensuring that assets will be available in the future. A third-party special needs trust is set up and funded by someone on behalf of the disabled person. Jonathan Greeson, CFP, a financial advisor living with spinal muscular atrophy (SMA), says the special needs trust his parents established on his behalf provides an inheritance for him while protecting benefits he currently receives.

“It also protects my parents by allowing them to decrease their assets for Medicaid planning purposes in the event that they need to go to an assisted living facility,” Jonathan says.

Jonathan Greeson is a financial advisor living with SMA.

A first-party special needs trust is established by the disabled individual using their own funds. Upon their death, the government can get paid back (claw back) for any public services the beneficiary received. Another type, the pooled special needs trust, is funded through a charitable entity.

Monique Castillo, a financial advisor at Higher Ground Financial Services, says a special needs trust can work well in combination with tools such as an ABLE account.

“The ABLE account has more immediate access, while the special needs trust requires planning and timing to access,” she says. “The ABLE account can be used more actively to round out a person’s life, while the special needs trust can be a great receptacle for a larger inheritance they might receive. ABLE accounts and special needs trusts are very different but complementary tools that can really help in planning for the future.”

Don’t wait

Time is everyone’s greatest investment tool. Whatever your situation, it’s important to start financial planning as soon as possible.

“When we wait to start planning, we lose that much time,” says financial advisor Jonathan. “Especially with the medical advances we have today, those of us with disabilities can start planning for a longer life. My parents were told I would die at 2 years old, but now I’m 38. It’s hard to imagine where we would be if they hadn’t planned with the hope that we would make it this far.”

Monique Castillo is a financial advisor who works with special needs clients.

Karen Doss Bowman is a freelance writer and editor living with progressive muscular atrophy, a subset of ALS, in Bridgewater, Va.

3 Tips to Get Started

Financial planning can give caregivers and individuals with disabilities a sense of security for the future. Here’s how to get started:

- Parents first. Parents should focus on their own retirement planning first. Ensuring their own financial security will benefit the whole family.

- Set goals. Parents of young children with neuromuscular disease can prepare a “letter of intent,” a non-legally binding document that lays the groundwork for the child’s future well-being. It covers everything from benefits received and financial goals to medical history and daily schedule.

- Build a team. Your team should include a financial advisor, accountant, and lawyer. You may also consult with close relatives or trusted friends, and it’s helpful to talk to families in similar situations. “There’s no magic solution to these challenges,” says Jonathan Greeson, CFP, a financial advisor living with SMA. “The key is to realize we aren’t alone — it’s a team effort.”

Real Stories

Learn how some members of our community are coping with financial impacts of the COVID-19 pandemic in “Creativity and Adaptability.”

Disclaimer: No content on this site should ever be used as a substitute for direct medical advice from your doctor or other qualified clinician.